Investing in the best small cap stocks can be a rewarding strategy for those looking to diversify their portfolio and capitalize on growth opportunities. Small cap stocks, often defined as companies with a market capitalization between $300 million and $2 billion, are known for their potential to offer substantial returns in the long run. However, they also come with greater risk compared to large-cap stocks. Understanding how to identify these promising small cap stocks can set you on the path to financial success.

Understanding Small Cap Stocks

Small cap stocks represent companies that are typically newer or in the growth phase of their business cycle. These firms are often leaders in emerging industries or niche markets, making them attractive to investors who are willing to take on more risk in exchange for higher potential rewards.

Why Invest in Small Cap Stocks?

There are several compelling reasons to invest in the best small cap stocks:

- Growth Potential: Small cap stocks can offer significant growth potential as they expand their market share and revenue.

- Diversification: Adding small cap stocks to your portfolio can help diversify your investments, spreading risk across different sectors and company sizes.

- Under-the-Radar Opportunities: Many small cap stocks fly under the radar of large institutional investors, providing individual investors with unique opportunities to invest early.

Key Factors to Consider When Choosing Small Cap Stocks

To identify the best small cap stocks, consider the following key factors:

Financial Health

Assess the financial stability of the company by examining its balance sheet, cash flow, and recent earnings reports. Look for companies with low debt levels and strong revenue growth.

Management Team

A capable and experienced management team is crucial for driving a company’s growth. Research the backgrounds and track records of the executives and board members.

Market Position

Determine the company’s position within its industry. Companies that have a competitive edge, proprietary technology, or a unique product offering are often better positioned for growth.

Read more about small stocks to buy now here.

Valuation

Even the best small cap stocks should be valued reasonably. Compare the stock’s current price to its earnings, revenue, and cash flow to ensure it is not overvalued.

Top Small Cap Stocks to Watch in 2023

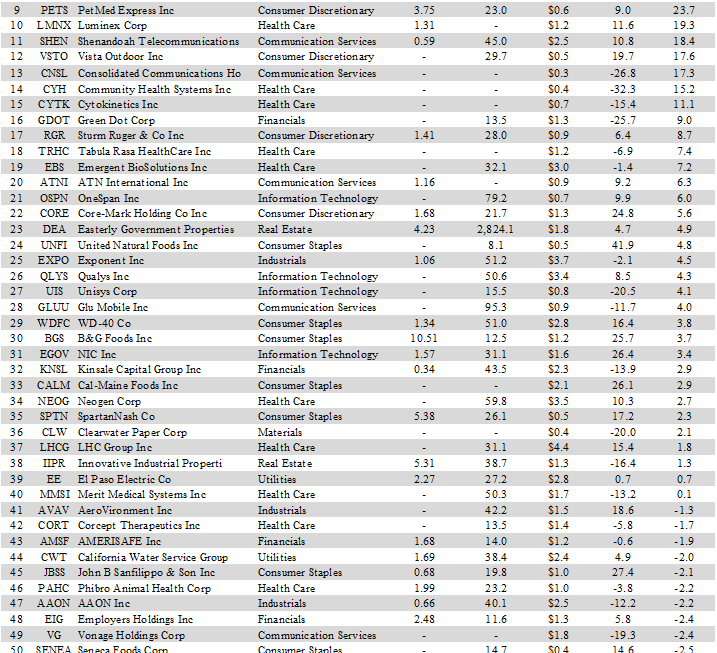

Here are a few promising small cap stocks that have garnered attention from analysts and investors:

- Company A: Known for its innovative technology and rapid growth in a niche market.

- Company B: A healthcare provider with a unique business model and strong financial performance.

- Company C: A renewable energy firm that has shown consistent revenue growth and industry leadership.

Risks Associated with Small Cap Stocks

While the best small cap stocks can offer impressive returns, it’s essential to be aware of the risks involved:

- Volatility: Small cap stocks can be more volatile than their larger counterparts, leading to larger price swings.

- Liquidity: These stocks often have lower trading volumes, which can make buying and selling shares more challenging.

- Market Fluctuations: Economic changes and market trends can impact small cap companies more severely than large corporations.

Conclusion

The pursuit of the best small cap stocks can be a lucrative endeavor for investors who conduct thorough research and remain mindful of the inherent risks. By focusing on financial health, management quality, market position, and valuation, you can better position yourself to pick stocks with high growth potential. As always, diversify your investments to mitigate risk and consult with financial experts to tailor your portfolio to your individual goals and risk tolerance.